Congress Passed Sarbanes-oxley Into Law as a Response to

Here in Washington today the Supreme Court seemed on the edge of invalidating the anti-fraud law passed in the wake of the Enron scandal. In the aftermath of scandals at Enron and other companies Congress four years ago passed the Sarbanes-Oxley Act.

Solved Congress Passed The Sarbanes Oxley Act Of 2002 To O Chegg Com

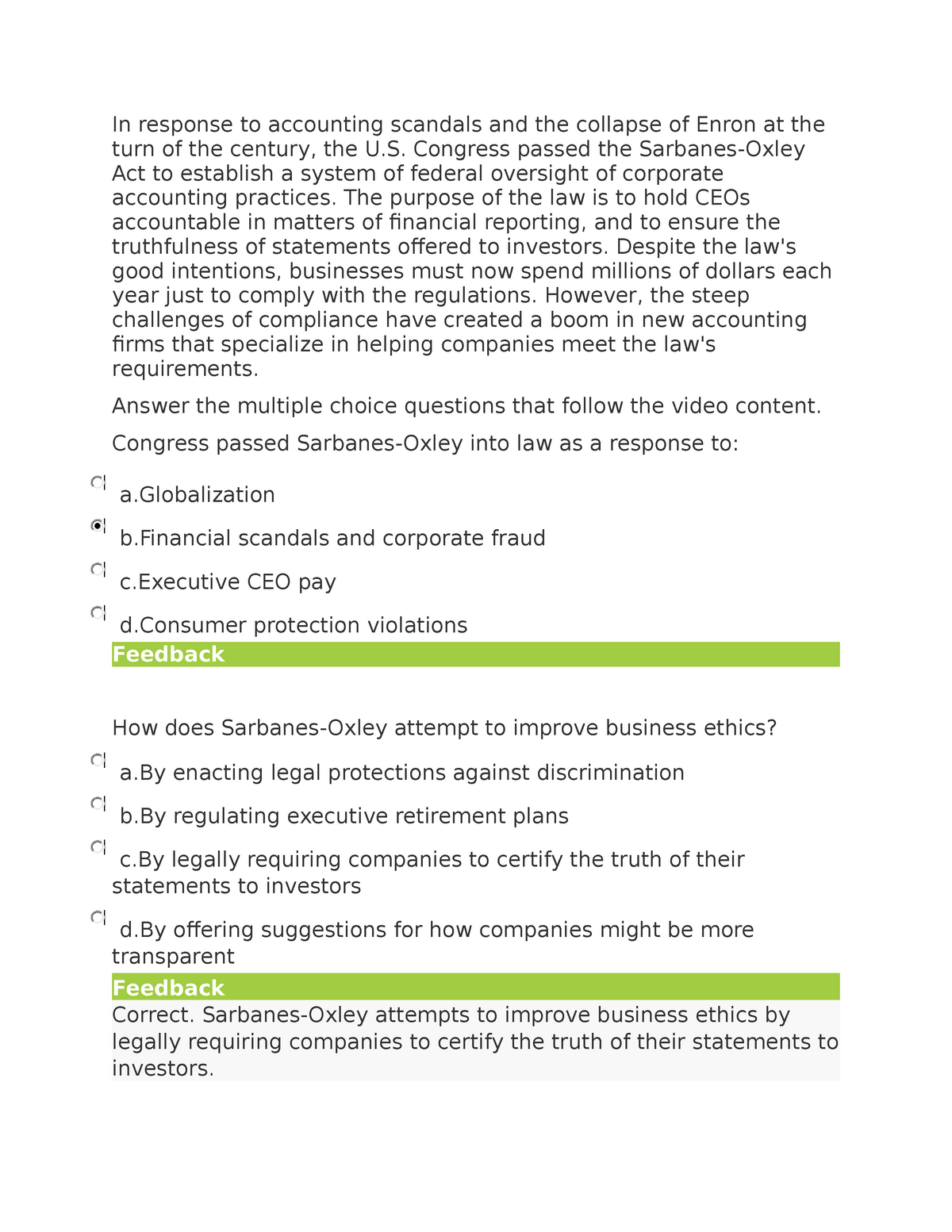

How does Sarbanes-Oxley attempt to improve business ethics.

. Oxley was passed in Congress on July 25 2002. The SarbanesOxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations. Congress passed Sarbanes-Oxley into law as a response to.

Afinancial scandals and corporate fraud. Congress in 2002 in response to a loss of confidence among American investors suggestive of the Great Depression. The Sarbanes-Oxley SOX Act of 20022 in which Congress introduced a series of corporate governance initiatives into the federal securities laws is not just a considerable change in law but also a departure in the mode of regulation.

I voted for the law which made many improvements to corporate governance and accounting. Congress passed the Sarbanes-Oxley Act to establish a system of federal oversight of corporate accounting practices. In reaction to the scandals Congress passed The Sarbanes-Oxley Act of 2002 PL.

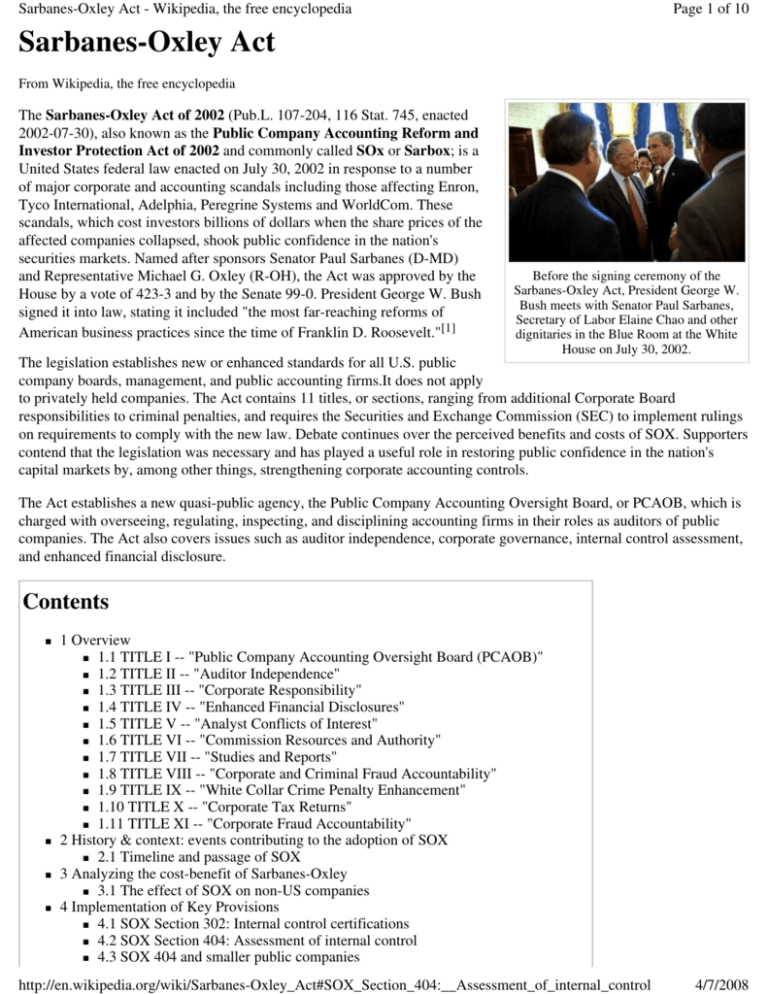

The SarbanesOxley Act of 2002 PubL. At that time he said that it brought about the most far-reaching reforms of American business practices since the time of Franklin Delano Roosevelt. 745 enacted July 30 2002 also known as the Public Company Accounting Reform and Investor Protection Act in the Senate and Corporate and Auditing Accountability Responsibility and.

The federal regime had until then consisted. Bby regulating executive retirement plans. Still regulating attorneys and in.

SOX And The Sarbanes-Oxley Act 2002 150 Words1 Page. The purpose of the law is to hold CEOs accountable in matters of financial reporting and to ensure the truthfulness of statements offered to. A recent speech by SEC Commissioner Allison Herren Lee brought corporate-attorney regulation back into the spotlight.

Now nearly 20 years after Congress passed the Sarbanes-Oxley Act the congressional mandate to promulgate and enforce rules for corporate attorneys has gone largely unfulfilled. It gave law enforcement new tools to fight corporate fraud. It made companies more accountable.

The two bills together with a flurry of other legislative proposals towards corporate reforms were. 107204 text 116 Stat. In response to public outcry over these corporate scandals Congress enacted the Sarbanes-Oxley Act which President Bush signed into law on July 30 2002.

In October 2008 a divided Congress passed the Emergency Economic Stabilization Act which provided the Treasury with approximately 700 billion to purchase troubled assets mostly bank shares. Aby enacting legal protections against discrimination. The law overhauled the way publicly traded companies are.

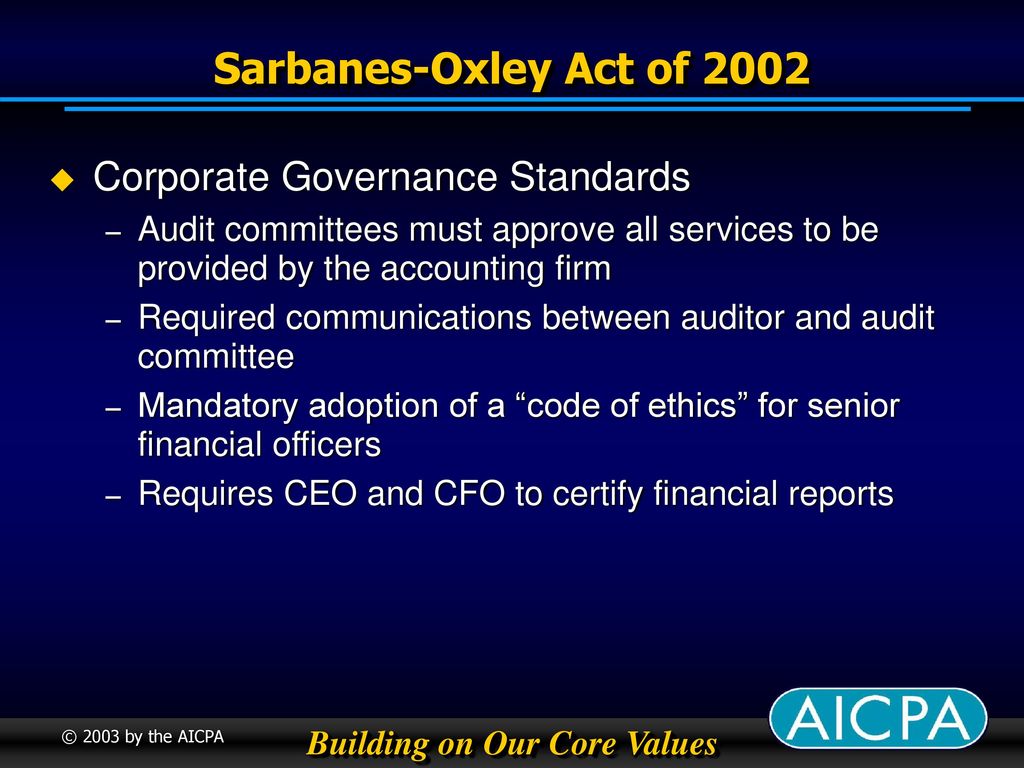

Sarbanes-Oxley also holds chief executives and chief financial officers directly responsible for the accuracy of financial statements. SOX as the law was quickly entitled was planned to. 1 oversee the audit of public companies that are subject to the securities laws.

107-204 and the Connecticut General Assembly passed An Act Concerning White Collar Crime Enforcement the Connecticut Uniform Securities Act and Corporate Fraud Accountability and Volunteer Firefighters and Members of Volunteer Ambulance Services or Companies PA. Sarbanes-Oxley Act of 2002 - Title I. 2 establish audit report standards and rules.

In response to accounting scandals and the collapse of Enron at the turn of the century the US. The SOA was passed in response to corporate scandals involving Enron WorldCom and others. But all that may change.

Bush signed the Sarbanes-Oxley Act into law on July 30 2002. In response Congress passed the Sarbanes-Oxley Act of 2002 SOX in an attempt to increase monitoring and improve corporate governance. It was intended to restore public.

745 enacted July 30 2002 also known as the Public Company Accounting Reform and Investor Protection Act in the Senate and Corporate and Auditing Accountability and Responsibility Act in the House and commonly called SarbanesOxley Sarbox or SOX is a United States federal law enacted on. Penalties run up to 5 million in fines a. Public Company Accounting Oversight Board - Establishes the Public Company Accounting Oversight Board Board to.

It strengthened investor protections. The Sarbanes-Oxley Act added a number of provisions to the Securities Act of 1933 1933 Act and the Securities Exchange Act of 1934 1934 Act in an attempt to increase the accuracy of audits and financial disclosures. ABSTRACT President Bush signed the Sarbanes-Oxley Act SOA into law on July 30 2002.

In conjunction with SOX exchange listing requirements required firms to have a majority of independent directors on their boards. The Sarbanes-Oxley Act of 2002 SOX was passed by Congress and signed into law by President Bush to mandate a number of reforms to enhance corporate responsibility enhance financial disclosures and combat corporate and accounting fraud and applies to all public companies in the US large and small The Laws That Govern the Securities Industry 2015. The Sarbanes-Oxley Act which combined the accounting reform bills of Sen.

The following was an Act passed by US. And 3 inspect investigate and enforce compliance on the part of registered public.

What Is The Sarbanes Oxley Act Empire Resume

Kopit Angina Sarbanesa Oxley Act Sarbanes Oxley Act 2002

Pdf Reforming Corporate Governance Via Legislation In The United States The Case Of The Sarbanes Oxley Act

The Sarbanes Oxley Act At 15 Ey Publication

The Sarbanes Oxley Act Video Lesson Transcript Study Com

Sarbanes Oxley Video Case In Response To Accounting Scandals And The Collapse Of Enron At The Turn Studocu

The Sarbanes Oxley Act Ppt Download

/us-president-george-w--bush-signs-hr-3763-as-membe-51681899-eedd5241d1ca43d5ad2d854242e9a1a7.jpg)

Sarbanes Oxley Sox Act Of 2002 Definition

Sox Compliance Everything You Need To Know In 2022 Tenfold

Sarbanes Oxley Act Sox By J Togar Horace

Sarbanes Oxley And Its Implications On Asian Companies Intellitrain

Pdf The Sarbanes Oxley Act And Accounting Quality A Comprehensive Examination

The Sarbanes Oxley Act Definition And Explanation Video Lesson Transcript Study Com

Pdf How Effective Is Sarbanes Oxley In The Accounting Profession Is It Accomplishing Its Original Objectives

Pdf Legislated Ethics From Enron To Sarbanes Oxley The Impact On Corporate America

Comments

Post a Comment